Why the classic Elliott Wave theory is useless in trading

Join the Premium Trading Chat Room!

FREQUENTLY ASKED QUESTIONS

What is Elliott Wave Theory

and how to use it in trading.

The Elliott Wave theory is a technical analysis method that is used to analyze financial market trends and predict future price movements. It is based on the idea that stock prices move in repeating patterns, or waves, which can be identified and used to make investment decisions. The theory was developed by Ralph Nelson Elliott in the 1930s and has since been widely adopted by traders and analysts.

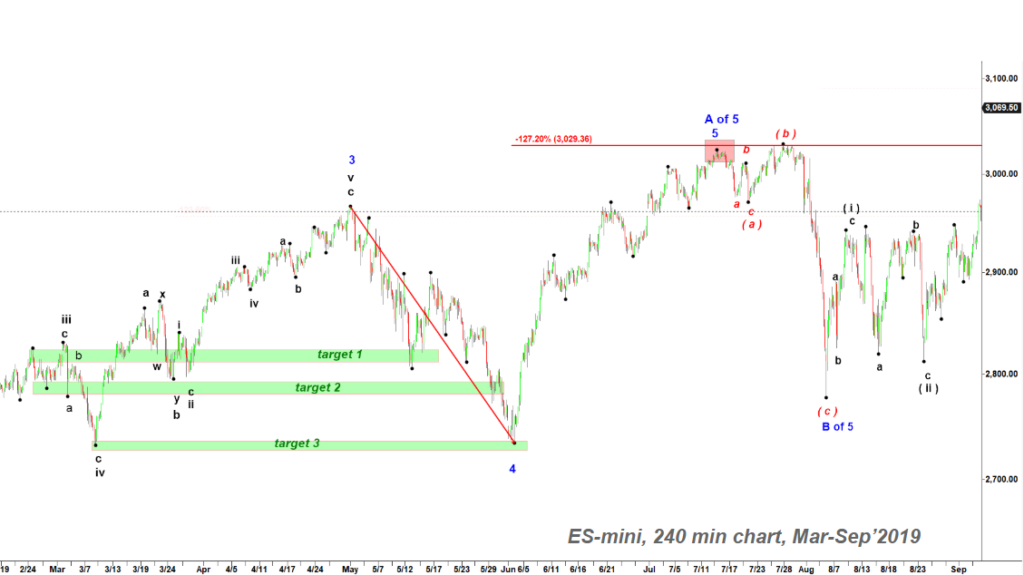

The Harmonic Elliott Wave theory is a modified better version of the classic Elliott Wave theory that is based on the idea that the natural rhythm of any financial market is a three wave pattern that can be associated with “action-reaction-resolution”. Those three step moves on charts showing prices of stocks, futures or crypto currencies form repeating and easy to recognize patterns that are based on specific Fibonacci ratios. These Fibonacci ratios are believed to be related to natural patterns and harmonic relationships that are found in nature, and they are used to identify specific points in the market where price movements are likely to occur.

I used to practice the classic Elliott Wave theory but then switched to the Harmonic Elliott wave theory because I found that the modified version predicted prices of stocks and futures moved in a more consistent manner than the classic Elliott Wave theory. This higher accuracy of the Harmonic Elliott Wave theory is based on specific repeating patterns, detailed rules of how recognize and confirm them and, finally, unconventional retracement and extension ratios. Together they produce more stable and reliable forecasting tool of market behavior than the more subjective wave counts used in the classic Elliott Wave theory.

There are several potential benefits of using Elliott Wave theory in stock trading:

(1) It can help traders identify trends. By identifying a specific patterns on a stock chart, traders can identify whether price has been moving in a trending impulsive wave or in a corrective pullback. Corrective pullbacks provide traders to make “reversal to mean” type of trades. Trending moves provide great opportunity for trend following strategies.

(2) Wave analysis provides valuable insight into market psychology. The Elliott Wave theory suggests that market trends are driven by the collective psychology of market participants. By understanding this psychology, traders can anticipate in advance how the market may react to important events like FOMC decision or release of important economic indicators like CPI or NFP. In addition, application of wave analysis allows traders to recognize moments when an up trending market enters the latest stage of a rally when price reaches new unsustainable highs being pushed up by retail traders driven by fear of missing out.

(3) The Harmonic Elliott Wave provides a trader with a powerful tool to measure extensions of the previous waves to correctly pin point potential targets of rallies and declines. That allows traders to successfully plan and execute exit strategy.

(4) It can help traders to manage risks and preserve capital:

– Elliott Wave theory can help traders to identify points of invalidation for specific scenarios that should be used as levels at which to set stop-loss orders.

By identifying trend reversals and potential turning points in the market, Elliott Wave theory can help traders manage their risk by providing a framework for determining exit points.

Stop-loss orders are used to protect against unexpected sharp market moves that may result in significant losses by automatically selling opened position when price reaches a certain level.

However, it is important to note that, like any technical analysis tool, Elliott Wave theory is not a guarantee of future performance and should be used in conjunction with other analysis techniques and risk management strategies.

You can recognize repeating patterns from the toolbox of the Harmonic Elliott Wave theory on any timeframe, from 1 min charts to Daily, weekly or even monthly timeframes. The same patterns works on any market including stocks, indices, forex, futures, currencies and commodities.

You can benefit from wave analysis either you are a short term day trader, a scalper or a long term investor. The Harmonic Elliott wave analysis is a powerful foundation for any style of discretionary trading because it provides you with skills of “reading charts”. A skilled wave analyst needs one glance at a chart to identify several most probable scenarios for price development for weeks ahead.

Unfortunately, the Harmonic Elliott wave theory is not the “Holy Grail” or crystal ball many desperate traders look for.

Very often that technique let you justify several equally probable scenarios of where price of stocks can move next. Consider the wave theory a framework or a toolbox that will make you a more disciplined and focused trader.

That tool will let you know when it is time to open a position, what targets you should expect and what are important support and resistance levels to be used as protective stops. Our tools once properly learned and practiced will give you a significant edge against other traders. You will be able to add to chart Red Target Box where price will most likley turn down and Green Traget boxes where price will most likely find support. You will be able to identufy when price turns into an impulsive (trending) mode and when it comes back in corrective pullbacks. But after all you will have to accurately apply all the rules of the theory to come up with a reliable forecast. Even experienced wave analysts sometimes make mistakes or overlook patterns.

Check out the latest market updates

March 5, 2026

No Comments

March 4, 2026

No Comments

Επιλέξτε 20 βετ για μια ασφαλή και διασκεδαστική εμπειρία στοιχημάτων και καζίνο. Με άδεια από την κυβέρνηση του Κουρασάο, η πλατφόρμα μας σας προσφέρει τις καλύτερες υπηρεσίες. Μην περιμένετε, εγγραφείτε σήμερα!

We can identify six distinctive groups of traders that differ in the way how they perceive incoming information, react to ideas produced by other groups and make they own trades Read more…

Join mr beast casino app and dive into a world where gaming meets generosity. Inspired by the incredible Mr. Beast, this casino offers more than just entertainment; it’s a place where you can win big while supporting great causes. Sign up today!

Wave Analysis of the US Stock Indices, Gold, Silver, Crude Oil and Natural Gas charts is posted on the web site from 8:00 AM to 11:00 PM EST. You get email notifications about every new update.

You get more intraday updates, ongoing Q&A session and CastAwayTrader shares his own trades with stocks and options.

The main benefit of joining the chat is ongoing process of teaching and mentorship. CastAwayTrader explains every trade and every setup in the light of Elliott Wave Trader. There is no such thing as “proprietary indicators”.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Predict The Market With The Harmonic Elliott Wave Analysis

Learn How to Nail Tops and Bottoms in Any Market. This course will teach you how to predict the next market move and become a pro Elliott wave trader.

How To Trade Like a Pro

How to Use Wave Analysis to Find Winning Trading Setups. This course will teach you hot to recognize high probability winning trading setups, how to set targets and protective stops

Επιλέξτε 20 βετ για μια ασφαλή και διασκεδαστική εμπειρία στοιχημάτων και καζίνο. Με άδεια από την κυβέρνηση του Κουρασάο, η πλατφόρμα μας σας προσφέρει τις καλύτερες υπηρεσίες. Μην περιμένετε, εγγραφείτε σήμερα!

Follow Us On Social Media

MEDIUM

YOUTUBE

The publisher of this web-site and videos is not registered as an investment adviser nor a broker/dealer with either the U. S. Securities & Exchange Commission or any state securities regulatory authority. Users of the website www.castawaytrader.com and viewers of the videos are advised that all information presented on the website is solely for informational purposes… Read More

Contact Us:

Email: castawaytrader@gmail.com