The best way to understand how this pattern works is to study collection of charts with real life examples.

- Subscribe Now and Start Learning

The subwave (c) of wave ( iii ) up is the strongest part of the rally. When it manages to overcome resistance at the top of preceding leg up in subwave (a) of wave ( iii ) up very often it opens with a gap up. It literally can jump over that resistance overnight. Many traders believe its a safe bet to short a gap up in anticipation of price to come back down and “fill” the gap. However, that is not the case for that type of gap up that happens in the middle of subwave ( c ) of wave ( iii ).

If we zoom-in to get a better look at the micro structure of the subwave (c) of wave ( iii ) we will see that that subwave has an impulsive structure and is subdivided into five smaller waves labelled as i, ii, iii, iv and v. And what is notable is that the gap up normally happens inside micro wave c of iii of subwave (c) of wave ( iii ) .

That kind of gap may stay unfilled for a relatively long period of time. In particular, it may contain two pullbacks, in micro wave iv down and even in the first leg down of the following pullback, specifically subwave (a) of wave ( iv ) down! Despite common belief that gaps are magnets attracting price for getting them filled, the upper boundary of such a gap becomes a very strong support that does not let price to get that gap filled. Only the second leg down of a corrective wave ( iv ) may finally break under that upper boundary and fill the gap created by subwave ( c ) of wave ( iii ) up.

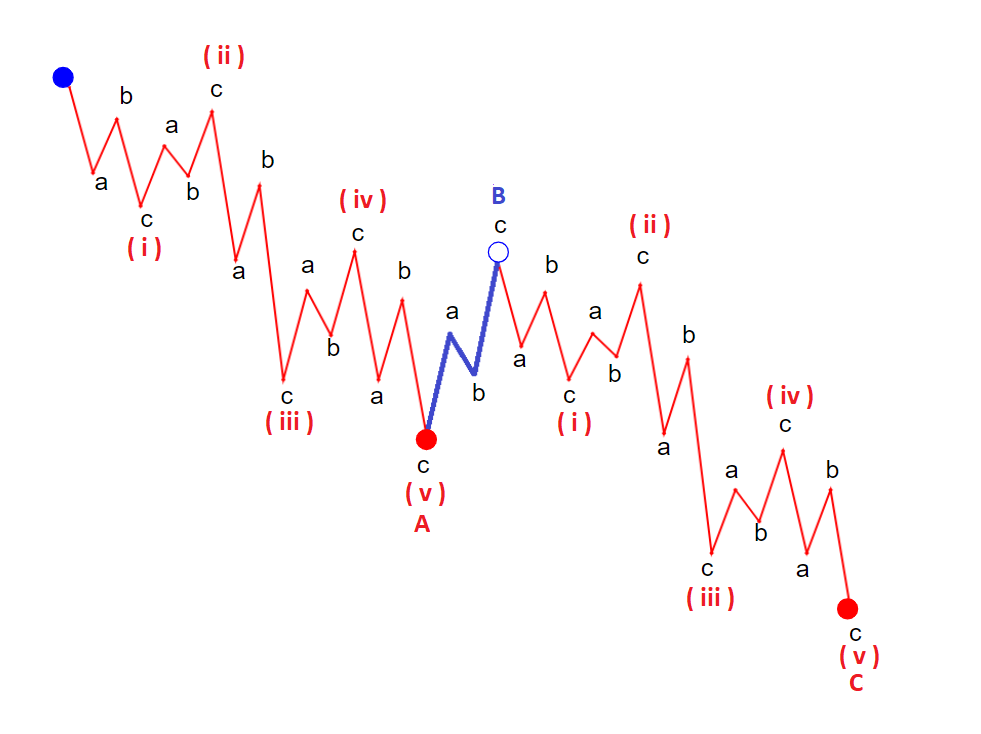

Simple Zig-Zag is the strongest type of a corrective wave. Waves A and C have impulsive structure. That is why corrective moves of this type are fast and deep.

The best way to understand how this pattern works is to study collection of charts with real life examples.

Trading is risky. Read this important Disclaimer

HIGH RISK WARNING

Trading stocks, options, or futures carries a high level of risk, and may not be suitable for all investors. Before deciding to trade, you should carefully consider your objectives, financial situation, needs and level of experience. CastAway Trader LLC provides general overview of trading methods that does not take into account your objectives, financial situation or needs. The content of this website must not be construed as personal advice. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore, you should not speculate with capital that you cannot afford to lose. You should be aware of all the risks associated with trading. You should seek advice from an independent financial advisor. Past performance is not necessarily indicative of future success.