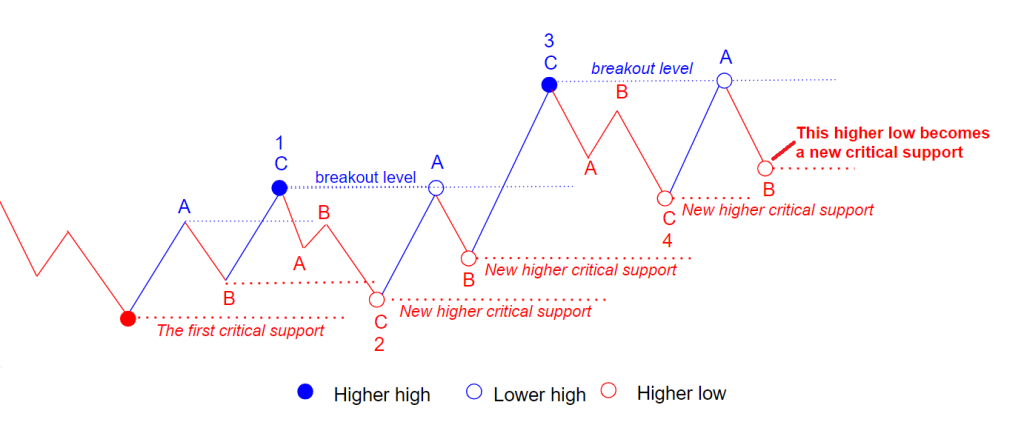

FIVE WAVE UP.

WAVE B of 5 DOWN

Wave B of 5 is a bearish reaction to a failed attempt of bulls to breakout through the resistance at the top of the wave 3 up. When wave A of 5 stalls right at the resistance established by the top of wave C of 3 ( it can either stop a little bit below or under it ) many traders would consider that price formation as a “double top”. In many cases wave B of 4 stops at the resistance at the top of the wave C of 3. Then this second test of that level is recognized as “triple top”. Old style traders who use conventional technical analysis would treat those two patterns as a short signal. That would give desperate bears another last hope about potential reversal of the rally and they would push prices lower again.

However, this corrective wave can not bring prices down even to the low reached by the previous corrective wave 4 down. That wave B of 5 sets another higher low and confirms to bulls that bears are weak and time has come for the real breakout to new higher highs in the final wave C of 5.

MAIN FEATURES

- Wave B of 5 down is subdivided into subwaves a, b and c

- Subwave c down normally makes a lower low under the bottom of the first leg down in subwave a down

- Wave B of 5 must hold over a critical support at the low of previous corrective wave 4 down

The best way to understand how this pattern works is to study collection of charts with real life examples.

- Subscribe Now and Start Learning