FIVE WAVE UP.

WAVE 1 UP

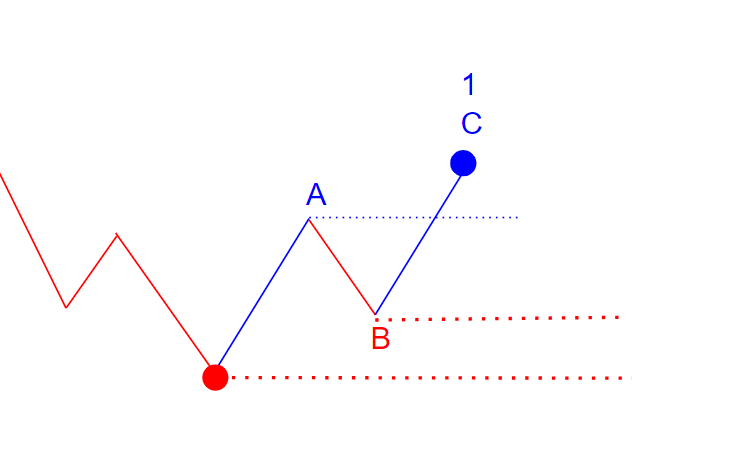

Wave 1 is the start of a new impulsive Five Wave Up fractal. It always starts off a significant bottom made by preceding corrective wave. That starting point of the first subwave A of wave 1 marked as the solid red dot on the picture above is the lowest point for the whole five wave up structure. After the first actionery move off the bottom in subwave A up gets exhausted, bears try to push price back down in a corrective subwave B down but they can’t break the low at the start of the subwave A. The atrting point of subwave A becomes the first critical support for the whole Five Wave up fractal. That means that the corrective waves B of 1 and a bigger correction in wave 2 down can not break under the lowest point of subwave A of 1. After a brief pullback in subwave B down bulls attack again and price makes a new higher high marked as the blue solid dot. That is a completion point, the top of wave 1 up.

MAIN FEATURES

- Wave 1 is subdivided into subwaves A, B and C

- The starting point of subwave A of 1 can not be breached by corrective subwave B of 1 and wave 2

- Subwave C up has to make a higher high over the top of the subwave A

In the video I explain all you the nitty-gritty details about this pattern

- Subscribe Now and Start Learning

The best way to understand how this pattern works is to study collection of charts with real life examples.

- Subscribe Now and Start Learning