GE not a value stock anymore with unclear structure off the low

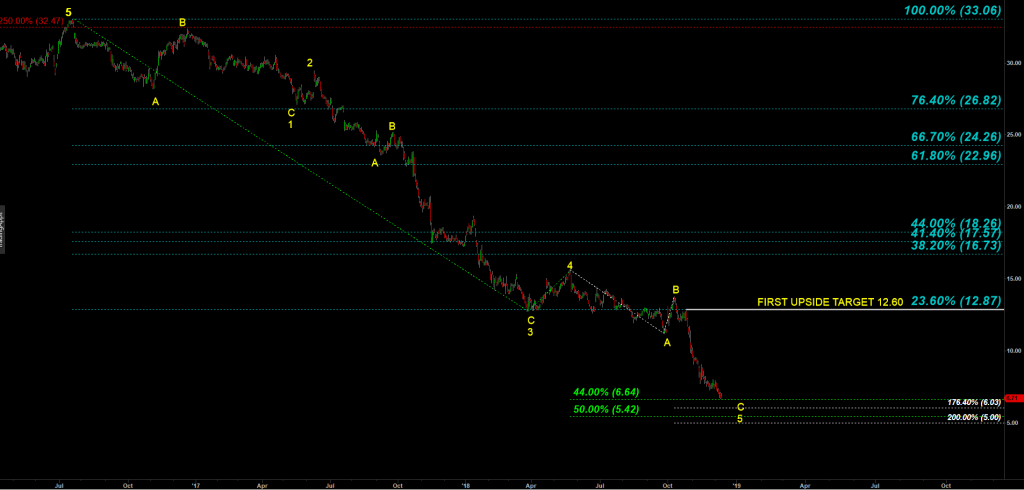

On 13 December 2018 I posted a bullish call with a target for a rally at 12.60. Back then GE was traded at 6.71. On 25 Feb 2019 it hit 11.29. I sold my shares a bit over $10.00 and never looked back. Easy money were made. I see many posts with frustrated traders asking rhetorical questions like “did GE really see the bottom” or “will that sh$t rally again?“. That made me curious to look again at the structure off that December 2018 low (please scroll below).

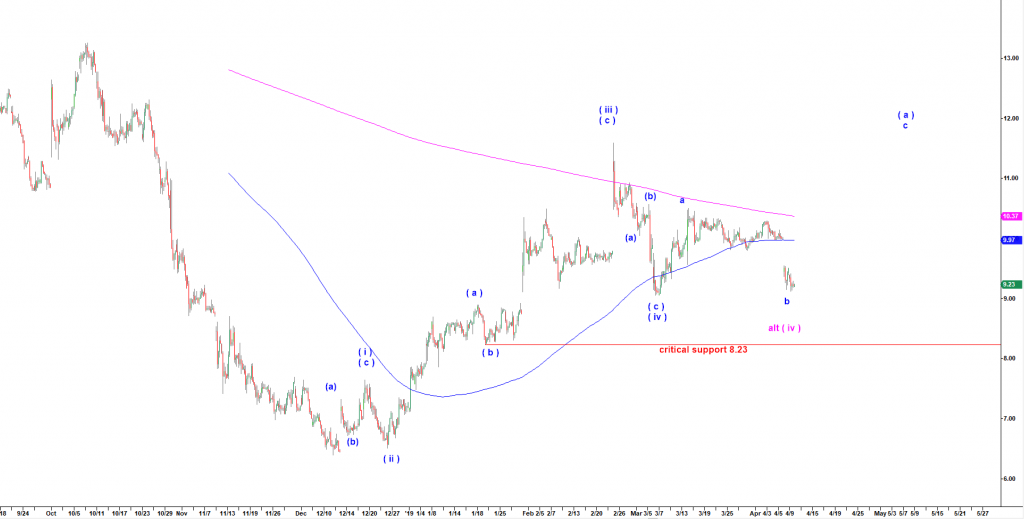

As you can see on the chart below updated today, we have got only three waves up off the December low. As long as it holds over 8.23 we may count that pullback off February 2019 top as a corrective wave iv down. Then it may rally first in wave ( a ) of ( v ) targeting the previous top in 12sh neighborhood, then a corrective wave ( b ) down, and, finally the final rally in wave ( c ) of ( v ) targeting a new higher high of 2019. That would be a completion of the wave A (subdivided into five smaller waves (i), (ii), (iii ), (iv) and (v) )started in December 2018 and the we may see a deep pullback down retracing substantial part of that rally in wave B down.

Another problem I stay cautious about GE is the fact that the company has been selling its best business to decrease its debt. Apparently that is not the best news for investors of that company.

I have found a number of great profitable companies with solid businesses and attractive valuation that have completed or about to complete nice bottoming patterns. They are much more interesting than GE.

Start to Learn Now!

Subscribe to my video course

and learn to predict market moves

YouTube Channel

Subscribe to my

YouTube channel

Check My Latest Updates!

Check out

the recent updates