<<< CHECK FUNDAMENTALS OF THE SECTOR

PHM - an efficient homebuilder that looks having bottommed

PulteGroup Inc is engaged in the homebuilding business. Its business includes the acquisition and development of land for residential purposes within the U.S. It is also engaged in mortgage banking operations.

This stock is very cheap now. It has Price-to-Free-Cash-Flow ratio at 5.4 and Free-Cash-Flow-Yield of 13.1%.

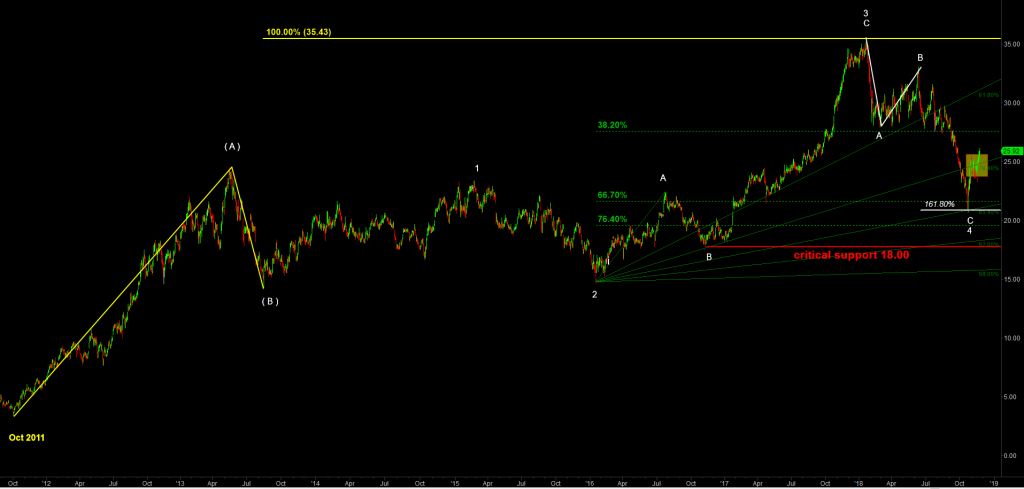

I count the rally off the 2011 low into the top made in May 2013 as wave ( A ) up.

The following corrective move down bottomed in August 2013 is a wave ( B ) down.

The resolution of that fractal in wave ( C ) up should have an impulsive structure and subdivided into five waves.

The strongest part of the rally in the wave 3 up topped in January 2018. Off that important top we got a corrective looking decline structure as A-B-C retracing 66.7% of the preceding rally in the wave 3. I count that decline as wave 4 down.

Off that October 2018 low we should expect another rally structured as A-B-C where the first leg of the rally should top the previous to reached in January 2018. The minimum target for the final leg up in wave C of 5 is 36.30 – 38.20. But it may stretch to 40.80-41.20.

The critical support that should hold to keep this bullish scenario alive is 18.00