Subscription: Access to Micro Counts of US indices

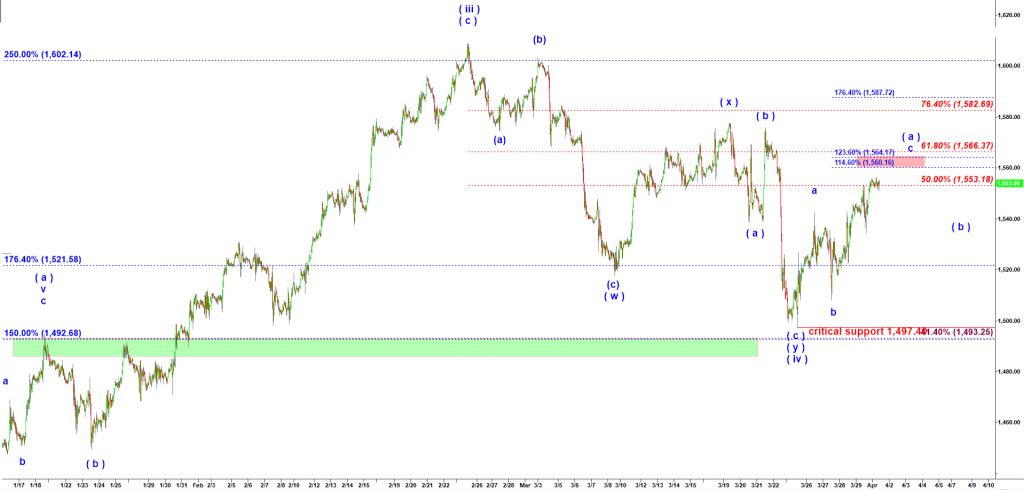

RTY - this move up looks like a start of a new rally in wave ( v ) up targeting new highs of 2019

On 29 March 2019 I explained two alternative paths for RTY. It seems like RTY wants to follow the bullish path I outlined in that post.

That count considers a top at 1,608.80 made on 2/25/2019 as the top of wave ( iii ) up. The corrective pullback that followed is a wave ( iv ) down. It bottomed at 1,497.40 on 3/25/2019. Of that bottom we should get a new (a)-(b)-(c) rally in wave ( v ) up targeting a new higher high of 2019.

As you can see on the chart below, RTY is approaching a red target box for the first move up off the low of the wave ( iv ) down. That a-b-c move up may stop at 1,560 – 1,564. Off that target box we may get a corrective decline in wave ( b ) down. I would not try to short for that pullback though. That pullback should be followed by a really strong rally in wave ( c ) of ( v ) that should reach a new higher high of 2019.

Start to Learn Now!

Subscribe to my video course

and learn to predict market moves

YouTube Channel

Subscribe to my

YouTube channel

Check My Latest Updates!

Check out

the recent updates