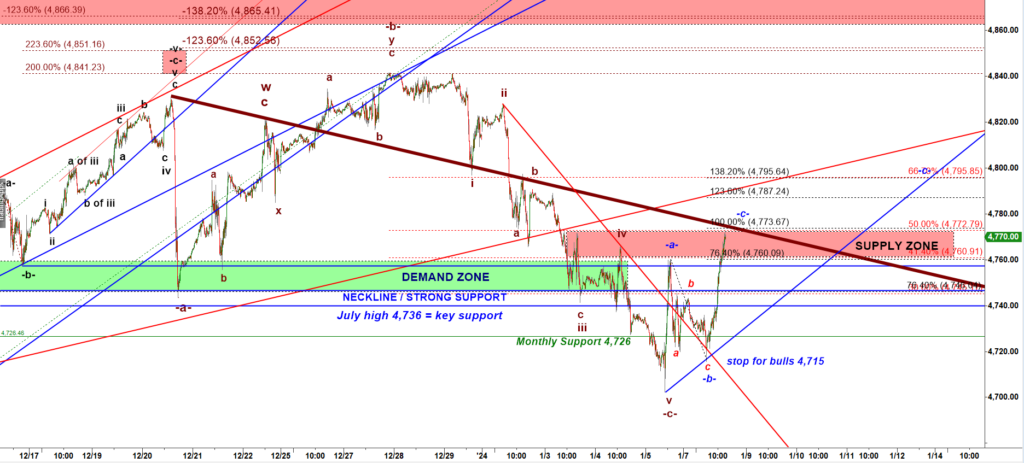

$ES #ES-mini #trading setup

“If bulls manage to reclaim the monthly support 4,727 we can see a quick rally pushing price back up to the Monthly Resistance 4,828.”

This is the Month Opening range strategy at its best:

The trading range of the first three full trading days created important boundaries we call the Monthly Support and the Monthly resistance. You can see that S&P made a low at 4,587.53 on the third trading day of a month. Then bears tested that low on the 4th trading day of a month but failed to break it. Trading is a zero sum game, if bears fail to break under a support, bulls get inspired to counter attack.

The Monthly Support for ES-mini is 4,727.

Here the rally in ES-mini has approached a resistance formed by confluence of two fibs:

- 4,772.75, a 50% retracement of the preceding decline, and

- 4,773.50, a 100% ext of the first leg up off the low.

In addition, at 4,773 ES will hit resistance of the dark red trend line.

So far Bulls produced a textbook corrective a-b-c up bounce off that key support. If bears manage to stop that rally under 4,774 that would leave bulls with a corrective bounce and provide bears with a very attractive short setup to break under the key support 4,737-4,726 and trigger a breakdown scenario that would allow bears to attack a support at 4,622 Gann’s level.

A break over 4,774 would open the door for a rally targeting a new higher high under the black path we discussed yesterday.