NQ - two scenarios and both point lower

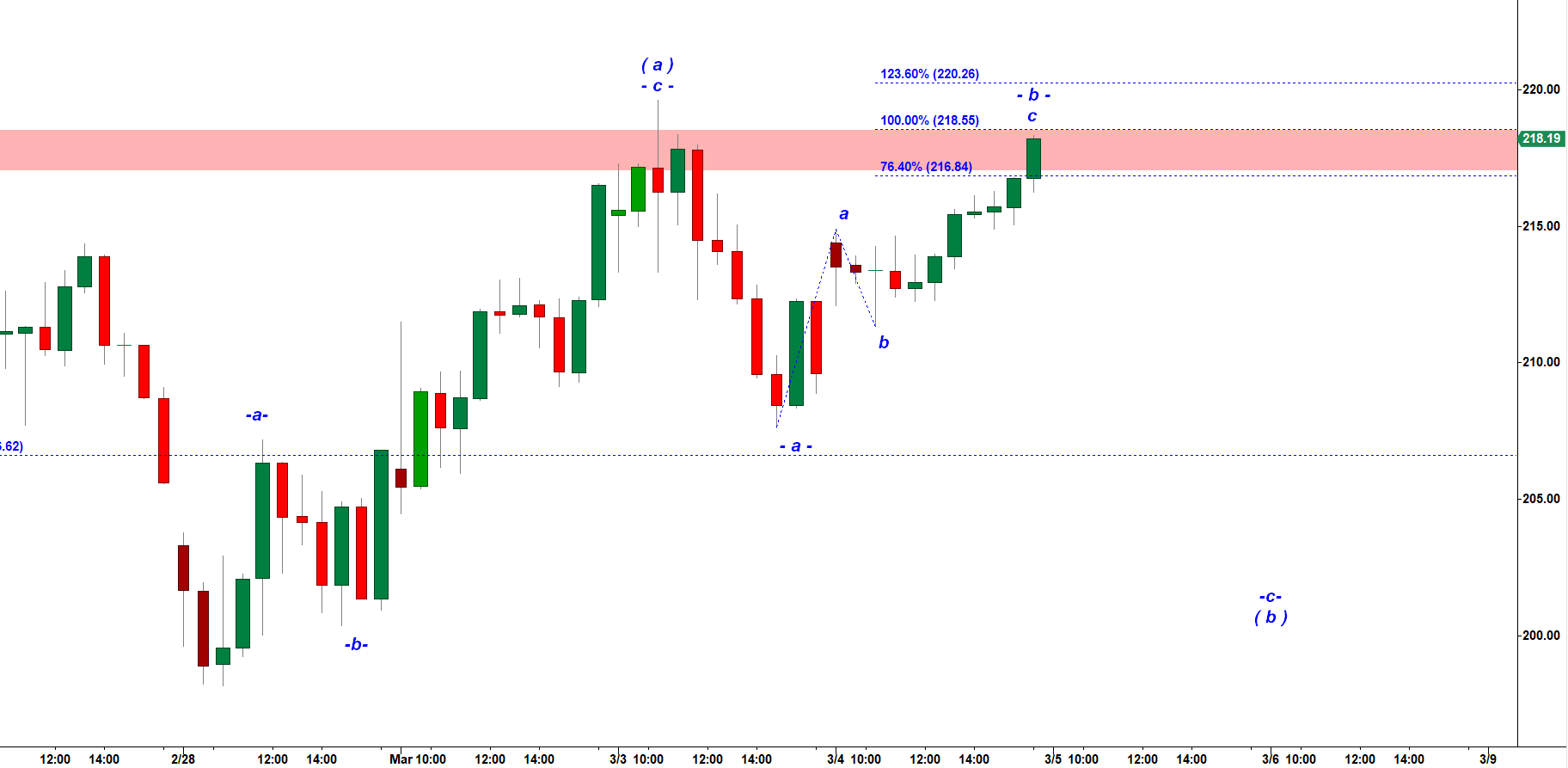

Let;s start from the updated chart of QQQ that I posted at 1.30 PM on Wednesday. QQQ topped right into the Red Supply zone shown on my chart.

I expect to get five wave down move in subwave -c- of wave ( b ) down followed by another strong rally in wave ( c ) up.

QQQ - 45 min chart updated at 4 PM on 3-04-2020

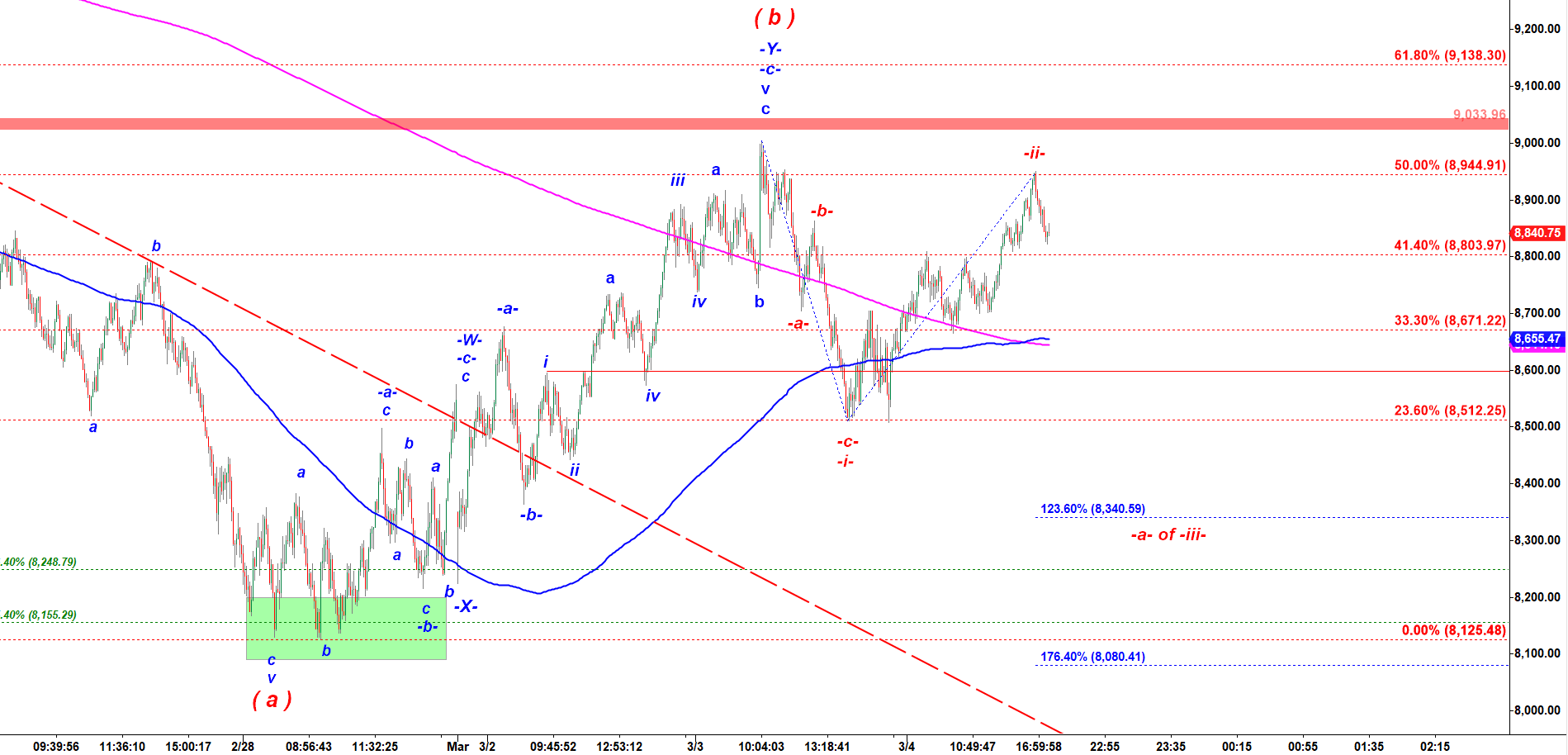

Below is a bearish alternative count of NQ.

It counts the first drop into Friday morning as the first leg down in wave ( a ) down.

A pullback that retraced 50% of the drop and topped on Tuesday morning with a spike on FED rate cut as a corrective wave ( b ) up.

That final subwave ( c ) down has to be structured into five waves down.

Yesterday we could get wave -i- down.

Today we could get a corrective wave -ii- up.

Then the next move is subwave a of wave -iii- down targeting 8,450 – 8,340.

NQ - 9,000 tick bar "BEARISH" chart updated at 10-23 PM on 3-04-2020

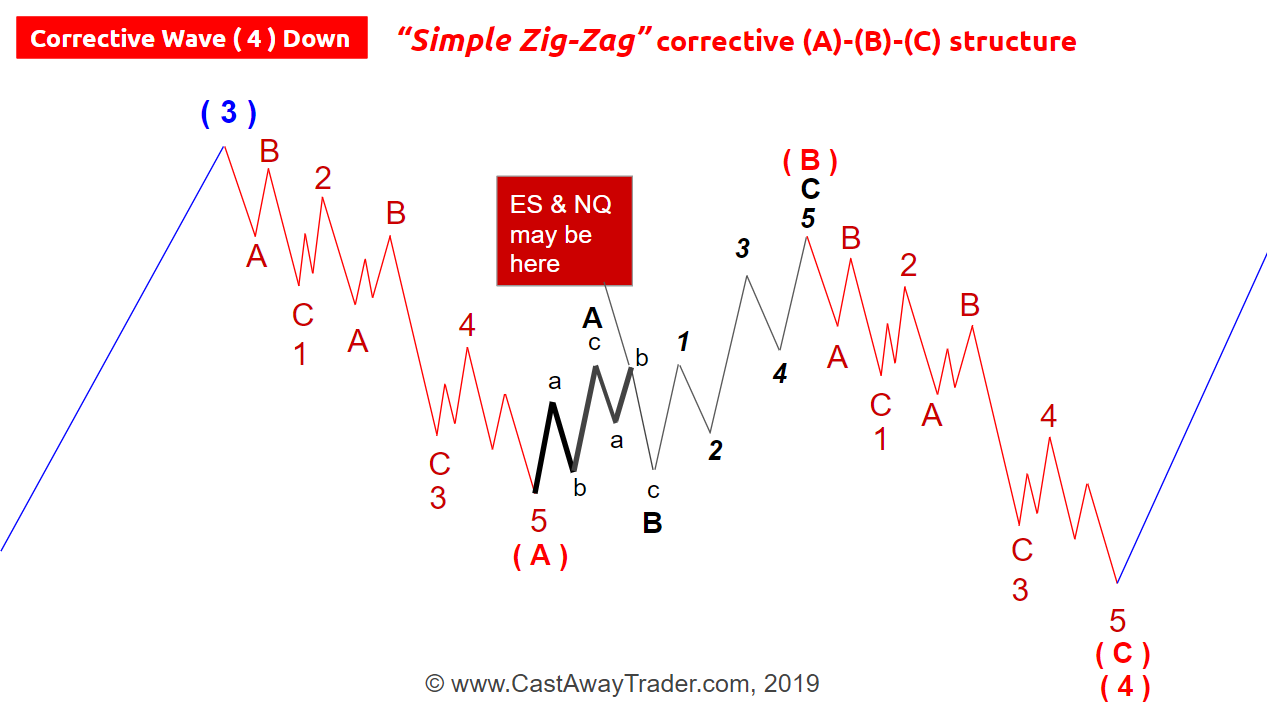

Now let’s talk about my primary scenario that we can call “NEUTRAL” (see blelow).

The neutral scenario also points down.

The main distinction from the “BEARISH scenario that after the first drop that can come back down to the last Friday’s lows we can get a strong rally in subwave ( c ) of wave ( B ) up (the green line).

NQ - 9,000 tick bar "NEUTRAL" chart updated at 10-23 PM on 3-04-2020

This is where NQ could be under the “NEUTRAL” scenario:

Trading is risky. Read this important Disclaimer

HIGH RISK WARNING

Trading stocks, options, or futures carries a high level of risk, and may not be suitable for all investors. Before deciding to trade, you should carefully consider your objectives, financial situation, needs and level of experience. CastAway Trader LLC provides general overview of trading methods that does not take into account your objectives, financial situation or needs. The content of this website must not be construed as personal advice. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore, you should not speculate with capital that you cannot afford to lose. You should be aware of all the risks associated with trading. You should seek advice from an independent financial advisor. Past performance is not necessarily indicative of future success.